Multiple Choice

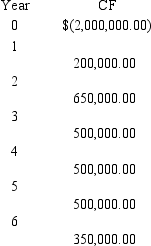

Emma is considering a new cat nip factory with the following cash flows,if the disoucnt rate is 7%,what is the NPV?

Definitions:

Related Questions

Q13: What are the total costs (underwriting and

Q15: What is Bavarian Sausage's breakeven point in

Q26: Kelley Group is considering an investment of

Q29: Investors can eliminate what type of risk

Q65: Refer to NPV Profile.Suppose the two projects

Q65: Bavarian Sausage stock has an average historical

Q71: Roxy Bonds have 14 years to maturity,with

Q88: Which of the following statements are CORRECT?<br><img

Q89: Louis Internationa is considering retiring a $180

Q145: You will receive a stream of annual