Normaltown Corporation

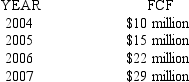

An analyst has predicted the free cash flows for Normaltown Corporation for the next four years:

-After 2007,the free cash flows are expected to grow at an annual rate of 5%.The weighted average cost of capital for Normaltown is 12%.If the market value of the firm's debt is $100 million,find the value of the firm's equity.

Definitions:

Human Rights

The basic rights and freedoms that all individuals are entitled to, regardless of nationality, sex, national or ethnic origin, race, religion, language, or other status.

Sarbanes-Oxley Act

A law enacted in 2002 aimed at improving corporate governance and preventing corporate fraud through stringent accounting and auditing regulations.

Corporate Wrongdoers

Companies or their representatives who have engaged in illegal, unethical, or improper conduct.

Ethical And Socially Responsible

Conducting oneself or an organization in a manner that is mindful of the welfare of society and operates within ethical standards and principles.

Q8: A bond's coupon rate<br>A) equals its annual

Q35: Emma is considering a new cat nip

Q37: You will receive a stream of payments

Q39: An annuity can best be described as<br>A)

Q40: A firm has a capital structure containing

Q43: Sunk costs:<br>A) are irrelevant.<br>B) should be considered

Q54: DDP Enterprises currently does not pay a

Q69: Which of the following statements is FALSE?<br>A)

Q82: Given Exhibit 7-5,what is the expected return

Q120: Roxy is buying a house and the