Normaltown Corporation

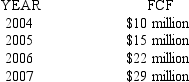

An analyst has predicted the free cash flows for Normaltown Corporation for the next four years:

-After 2007,the free cash flows are expected to grow at an annual rate of 5%.The weighted average cost of capital for Normaltown is 12%.If the market value of the firm's debt is $100 million,find the value of the firm's equity.

Definitions:

Money-Creation Process

The procedure through which the banking system generates money by issuing loans greater than the amount of reserves it holds.

M1

The measure of a country's money supply that includes physical currency and coin, demand deposits, traveler's checks, and other checkable deposits.

Bank Vaults

Secure rooms or compartments within banks where valuables, including money, documents, and other assets, are stored for protection against theft and fire.

Currency

The system of money in general use in a particular country or region, facilitating the transfer of goods and services.

Q7: According to historical data,in the last 106

Q8: Forever Insurance Company has offered to pay

Q28: An investor has $10,000 invested in Treasury

Q47: What type of mutual fund managers do

Q53: Which of the following is a problem

Q54: When a firm operates at less than

Q83: Pink Sheets refer to:<br>A) the confirmation notice

Q83: Purple Bell Butter Company increased its sales

Q101: You find that the yield on a

Q135: You have the choice between two investments