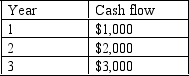

Consider the following cash flows each arriving at the end of the year.If the discount rate is 15% ,what is the (3-year) EQUIVALENT ANNUITY ?

Definitions:

Net Present Value

A financial metric that calculates the current value of a series of future cash flows by discounting them back to the present time.

Interest Rate

The part of a loan that accrues interest for the borrower, customarily denoted as a yearly percentage of the loan's outstanding sum.

Inflationary Premium

The portion of investment returns or interest rates that compensates for expected inflation, protecting the purchasing power of money.

Time Preference

The degree to which individuals value present goods or satisfaction over future goods or satisfaction.

Q3: If P<sub>1</sub> = $5, Q<sub>1</sub> = 10,000,

Q11: If X > 0 in the primal

Q28: Derived demand is directly determined by:<br>A) utility.<br>B)

Q57: If you deposit $10,000 today in an

Q68: The difference between the return on the

Q76: Modern financial markets are:<br>A) competitive.<br>B) transparent.<br>C) efficient.<br>D)

Q76: Roxy Corp has an operating profit of

Q80: When investors take a short position in

Q88: A bank account has a rate of

Q140: You want to buy a house in