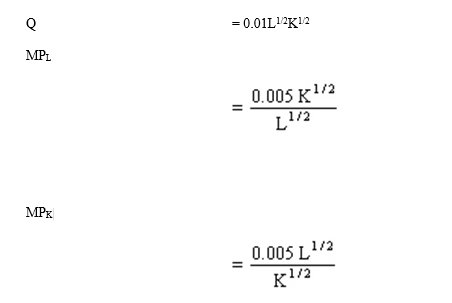

Fixed Input Relations. Extreme Biking, Inc., assembles high-end extreme mountain bicycles at a plant in Lexington, Massachusetts. The plant uses labor (L) and capital (K) in an assembly line process to produce output (Q) where:

A. Calculate how many units of output can be produced with 25 units of labor and 400 units of capital, and with 225 units of labor and 3,600 units of capital. Are returns to scale increasing, constant, or diminishing?

B. Calculate the change in the marginal product of labor as labor grows from 25 to 36 units, holding capital constant at 400 units. Similarly, calculate the change in the marginal product of capital as capital grows from 400 to 625 units, holding labor constant at 25 units. Are returns to each factor increasing, constant, or diminishing?

C. Assume now and throughout the remainder of the problem that labor and capital must be combined in the ratio 25L:400K. How much output could be produced if the company faces a constraint of L = 25,000 and K = 500,000 during the coming production period?

D. What are the marginal products of each factor under the conditions described in part C?

Definitions:

Payment Interval

The frequency at which payments are made, such as monthly, quarterly, or annually.

Compounded Annually

Interest on an investment or loan calculated once a year, taking into account the interest that has accrued in the previous period.

Current Economic Value

An estimation of the present worth of an asset or company based on its capacity to generate income in the current economic environment.

Compounded Monthly

A method where interest is calculated monthly and added to the principal sum, resulting in interest on interest.

Q13: Profit Contribution Analysis. Ben Laden Rugs, Inc.,

Q18: End-of-game Problem. One of the most vexing

Q26: The forecasting technique least-suited for short term

Q31: Costs of Regulation. The Montana Coal Company

Q36: Endogenous determinants of demand include:<br>A) competitor prices.<br>B)

Q41: Demand Estimation for Public Goods. The nonrival

Q43: Total revenue increases at a constant rate

Q43: The difficulty of selling corporate assets at

Q44: The acquisition cost of an asset is:<br>A)

Q51: A 15-year,8%,$1000 face value bond is currently