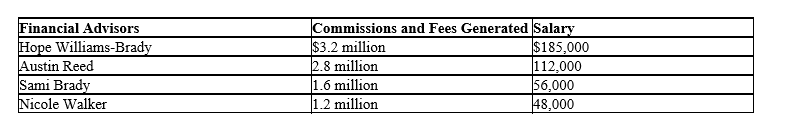

Optimal Input Mix. Salem-based Horton & Brady, Inc., is a small firm offering a wide variety of stock brokerage and financial services to high net worth individuals. Mickey Horton, president of Horton & Brady is reviewing the company's compensation plan. Currently, the company pays its three experienced financial advisors a salary based on the number of years of service. Nicole Walker, a new sales trainee, is paid a more modest salary. Sales and salary data for each employee are as follows:

Walker in particular has shown great promise during the past year, and Horton believes a substantial raise is clearly justified. At the same time, some adjustment to the compensation paid other sales personnel would also seem appropriate. Horton is considering changing from the current compensation plan to one based on a 5% commission. Horton sees such a plan as fairer to the parties involved and believes it would also provide strong incentives for needed market expansion.

A. Calculate Horton & Brady's salary expense for each employee expressed as a percentage of the commissions and fees generated by that individual.

B. Calculate income for each employee under a 5% commission-based system.

C. Will a commission-based plan result in efficient relative salaries, efficient salary levels, or both?

Definitions:

Professional Standard

Guidelines and criteria established by professions to ensure quality, competence, and ethical practice among its members.

Nonpartisanship

An approach to governance or policies that does not formally align with partisan political parties or biases.

Cynicism

A mindset or attitude characterized by a general distrust of others' motives, believing that self-interest is the primary driver of human behavior.

Television Network

An organization that distributes television programming content to affiliated broadcast stations or cable TV providers.

Q24: Demand Curve Estimation. The Real Kool Toys

Q29: Simultaneous Equations. Buckeye Cinema, Inc., which runs

Q29: Nonprice Competition. Tickets, Inc., uses mall intercept

Q37: What should be the objective of a

Q40: When the dispersion of possible returns is

Q41: To justify an investment that involves an

Q42: Social Rate of Discount. Assume that the

Q61: After graduating from college with a finance

Q70: Agency costs refer to<br>A) the costs associated

Q73: A young graduate invests $10,000 in a