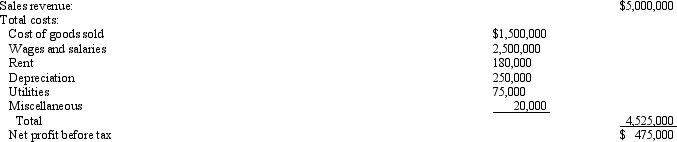

Incremental Analysis. Warren Buffet is a medium-sized restaurant located in Omaha, Nebraska. Warren Buffet currently offers elegant dining to luncheon and dining customers. The restaurant's most recent annual net income statement is as follows:

Luncheon and dining customer sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Warren Buffet is considering offering a new Sunday buffet brunch service. Warren Buffet would offer Sunday brunch for an initial two-year period, and then reevaluate its profitability. Offering a Sunday brunch would require an initial outlay of $10,000 to cover new buffet equipment and utensils. This is the only capital investment required during the initial two-year period. At the end of that time, additional capital would be required to continue operation, and no capital would be recovered if the buffet were dropped. Buffet sales of $300,000 are anticipated, and the share of revenues devoted to cost of goods sold expenses are expected to represent the same as previously. Wage and salary expenses are expected to increase by 8% and utility expenses by 5%. No other incremental costs are expected.

Luncheon and dining customer sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Warren Buffet is considering offering a new Sunday buffet brunch service. Warren Buffet would offer Sunday brunch for an initial two-year period, and then reevaluate its profitability. Offering a Sunday brunch would require an initial outlay of $10,000 to cover new buffet equipment and utensils. This is the only capital investment required during the initial two-year period. At the end of that time, additional capital would be required to continue operation, and no capital would be recovered if the buffet were dropped. Buffet sales of $300,000 are anticipated, and the share of revenues devoted to cost of goods sold expenses are expected to represent the same as previously. Wage and salary expenses are expected to increase by 8% and utility expenses by 5%. No other incremental costs are expected.

A. Calculate net incremental cash flows for the Sunday buffet.

B. Assume that Warren Buffet's has the necessary capital and places a 20% before-tax opportunity cost on those funds. Should the buffet service be offered? Why or why not?

Definitions:

Stop Manufacturing

The act of halting the production or assembly of products in a manufacturing process.

Specific Performance

A legal remedy requiring a party to perform their specific duties under a contract, rather than paying damages.

Implicit Guarantee

An unstated or implied promise or assurance, often believed to exist due to past practices or general market perceptions.

Future Performance

A contractual commitment to perform a service or deliver a product at a future date.

Q3: If P<sub>1</sub> = $5, Q<sub>1</sub> = 10,000,

Q5: Marginal Analysis: Tables. Lynette Scavo is a

Q10: With price discrimination, higher prices are charged

Q19: Certainty Equivalents. Rajun Cajun's, Ltd., is a

Q24: A monopolist maximizes profits by producing a

Q27: Optimal Markup. Carol Vessey is a managing

Q27: Incremental Analysis. Warren Buffet is a medium-sized

Q32: Cartel Pricing. The domestic color separator manufacturing

Q35: The following market cannot be described as

Q48: Demand is always reduced by unanticipated changes