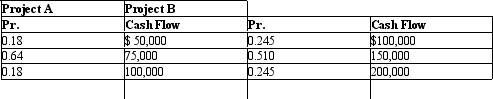

Expected Return. Manhattan Transfer, Inc., is considering two alternative capital budgeting projects. Project A is an investment of $225,000 to renovate warehouse facilities. Project B is an investment of $450,000 to expand distribution facilities. Relevant annual cash flow data for the two projects over their expected five-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 15% cost of capital for the more risky project and 12% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

Definitions:

Balance Sheets

Financial statements that show a company's assets, liabilities, and equity at a specific point in time.

Fixed Assets

Long-term assets that a company uses in the production of its goods and services, such as buildings, machinery, and equipment, which are not expected to be converted into cash in the short term.

Investing Activity

Financial transactions related to an entity's investments in long-term assets, including property, plant, equipment, and securities.

Capital Stock

The total amount of common and preferred shares that a company is authorized to issue, representing the equity ownership of the company.

Q4: Since interest and taxes are deductible by

Q5: Sales Forecast Modeling. The change in the

Q11: The burden of a per unit tax

Q17: External Social Benefits. During recent years, professional

Q17: The primary virtue of managerial economics lies

Q31: Geneva,a sole proprietor,sold one of her business

Q37: Regarding technical advice memoranda,which statement is incorrect?<br>A)Issued

Q37: Optimal Price. Last month, Forest Lumber, Inc.

Q39: Cost of Capital. Chock Full O'Coffee, Inc.,

Q43: Optimal Input Level. Just Bikes, Inc., sells