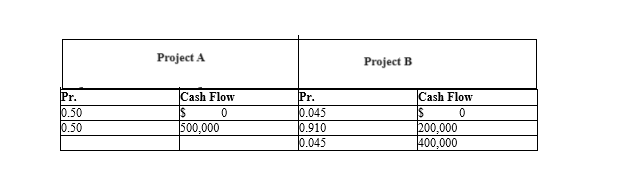

Expected Return. Dr. Kevin Lenahan & Associates is a local optometrist considering two alternative capital budgeting projects. Project A is an investment of $800,000 in a new office addition to showcase an expanded selection of designer frames and contact lenses. Project B is an investment of $750,000 to upgrade existing testing facilities. Relevant annual cash flow data for the two projects over their expected seven-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 20% cost of capital for the more risky project and 15% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

Definitions:

Cost of Goods Sold

The direct expenses related to producing goods sold by a company, including material costs and direct labor, essential for calculating a company's gross profit.

Current Ratio

It's a measure used to determine a business's capacity to fulfill obligations due in less than one year, through a calculation of current assets over current liabilities.

Acid-Test Ratio

A financial metric that measures the ability of a company to pay off its short-term liabilities with its quick assets.

Year-End Information

Data and records compiled at the end of a fiscal year used for accounting and tax purposes, including final balances, inventories, and financial statements.

Q3: Economic rents are profits due to:<br>A) luck.<br>B)

Q14: The discount rate that equates present value

Q17: Markup on Price. Carpet Magic, Inc., provides

Q23: Incremental Analysis. Grey's Anatomy, Ltd., is contemplating

Q27: Comparative Statics. Coupon Promotions, Inc., is a

Q29: The quality-control potential of high-tech firms tends

Q30: Sales Forecast Modeling. Consulting Associates, Ltd., would

Q31: Union organizing expenses are a type of:<br>A)

Q45: The relationship between McDonalds and Coca-Cola is:<br>A)

Q47: A firm must choose between two projects,