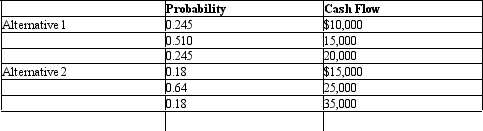

Probability Analysis. The Medical Centre is considering taking on a new lease for additional office space in alternative suburban shopping areas. Alternative 1 requires a current investment outlay of $50,000; alternative 2 requires an outlay of $75,000. The following cash flows will be generated each year over an initial five-year lease period.

A. Calculate the expected cash flow for each investment alternative.

A. Calculate the expected cash flow for each investment alternative.

B. Calculate the standard deviation and coefficient of variation of cash flows (risk) for each investment alternative.

C. The firm will use a discount rate of 15% for the cash flows with higher degree of dispersion and a 12% rate for the less risky cash flows, calculate the expected net present value for each investment. Which alternative should be chosen?

Definitions:

Predetermined Level

A set benchmark or standard established in advance to guide production activities or cost estimations.

Cost Variance

The difference between the expected (budgeted) cost of an activity and its actual cost.

Standard Cost

A predetermined cost serving as a benchmark for evaluating the actual cost performance of activities.

Actual Cost

The actual expenses incurred in producing a product or delivering a service, including all direct labor, materials, and overhead costs.

Q2: Managerial economics cannot be used to identify:<br>A)

Q5: Demand Analysis. The CSI DVD (season four)

Q5: Expected Demand Estimation. Snack Foods International, Ltd.

Q10: With price discrimination, higher prices are charged

Q15: At the profit maximizing level of output

Q36: Marginal Analysis: Tables. Bree Van De Camp

Q38: The costs of pollution taxes are shared

Q43: A forecast method based on the informed

Q47: Econometric methods:<br>A) combine economic theory with mathematical

Q47: A price floor is a costly and