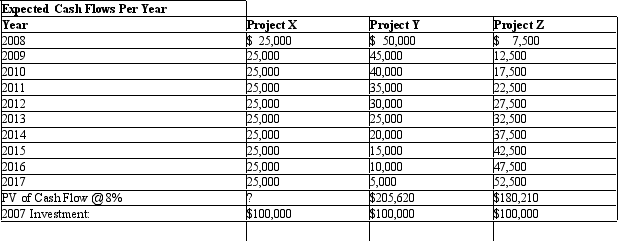

Certainty Equivalent Method. Saddie Hawkins, a management analyst with Mobile Telephone Services, Inc., has collected the following information about three investment projects undertaken by the firm during the past six month period. Hawkins wishes to use this information as a backdrop against which to evaluate the attractiveness of a recent investment proposal put forth by the quality control department. In that proposal, dubbed Project X, the quality control department proposes to spend $100,000 to modify transmission equipment at the Colorado Springs, Colorado facility. Annual expected cost savings of $25,000 per year over the 10-year 2005-2014 period have been projected, and verified as reasonable by Hawkins.

A. Calculate the present value of anticipated cost savings using an 8% discount rate as a reasonable estimate of the risk-free cost of capital.

A. Calculate the present value of anticipated cost savings using an 8% discount rate as a reasonable estimate of the risk-free cost of capital.

B. In light of the $100,000 investment required for each of these projects, and the discounted present value of future benefits, calculate the certainty equivalent adjustment factor a implicit in the decision to fund each of these investment projects.

C. Assume that the a's implicit in the decisions to fund projects Y and Z represent the upper limits for investment projects of this type. Would a decision to fund project X be consistent or inconsistent with the firm's decision to fund projects Y and Z?

Definitions:

Functional Plan

a detailed description of how specific tasks or functions will be executed within a project or organization to achieve set objectives.

Corporate Strategy

Involves the overarching plans and objectives a company adopts to achieve competitive advantage, growth, and sustainability.

Tactical Plan

A short-term strategy designed to address specific goals, often as part of a broader strategic plan.

Tactical Plans

Short-term actions designed to achieve specific objectives, often as part of a larger strategic plan.

Q2: Average Cost Minimization. Commercial Recording, Inc., is

Q5: Expected Demand Estimation. Snack Foods International, Ltd.

Q17: A natural monopoly exists if:<br>A) marginal revenue

Q18: Per Unit Tax and Elastic Demand. Assume

Q33: Tariffs. The Manchester Shoe Corporation is an

Q35: Change in the quantity supplied is caused

Q36: In 2008,Fox Corporation had taxable income of

Q40: Elasticity Estimation. Breakaway Tours, Inc., has estimated

Q44: Horizontal and Vertical Relations. International Business Machines

Q45: A leading economic indicator of business cycle