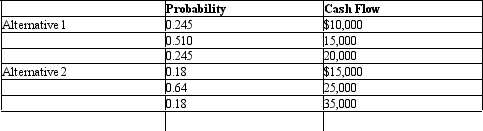

Probability Analysis. The Medical Centre is considering taking on a new lease for additional office space in alternative suburban shopping areas. Alternative 1 requires a current investment outlay of $50,000; alternative 2 requires an outlay of $75,000. The following cash flows will be generated each year over an initial five-year lease period.

A. Calculate the expected cash flow for each investment alternative.

A. Calculate the expected cash flow for each investment alternative.

B. Calculate the standard deviation and coefficient of variation of cash flows (risk) for each investment alternative.

C. The firm will use a discount rate of 15% for the cash flows with higher degree of dispersion and a 12% rate for the less risky cash flows, calculate the expected net present value for each investment. Which alternative should be chosen?

Definitions:

Preexisting Schema

A cognitive framework or concept that helps organize and interpret information, based on prior experiences and knowledge.

Prior Expectations

Presumptions or beliefs about future events or outcomes, formed based on past experiences or acquired knowledge.

Radically Disconfirms

A term that appears to indicate a strong or complete contradiction of expectations or beliefs, potentially leading to a change in those beliefs.

Sentence-Unscrambling Task

A cognitive task used in psychological experiments where participants must rearrange words to form correct sentences, often used to study priming effects.

Q1: Marginal Analysis: Tables. Susan Mayer is a

Q6: Cost of Capital. Marine Transport, Ltd., operates

Q9: Demand Estimation for Public Goods. Assume that

Q14: The Identification Problem. Business is booming for

Q28: The demand faced by an industry price

Q42: Optimal Input Mix. Hydraulics Ltd. has designed

Q45: The optimal output decision:<br>A) minimizes the marginal

Q55: Mississippi and North Carolina are community property

Q59: Which of the following statements relating to

Q85: The passive loss rules apply more favorably