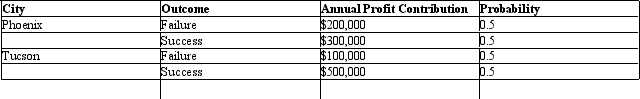

Probability Analysis. Tex-Mex, Inc. is a rapidly growing chain of Mexican-food restaurants. The company has a limited amount of capital for expansion, and must carefully weigh available alternatives. Currently, the company is considering opening restaurants in Phoenix and/or Tucson, Arizona. Projections for the two potential outlets are:

Each restaurant would involve a capital expenditure of $1.5 million, plus land acquisition costs of $500,000 for Phoenix and $1,050,000 for Tucson. The company uses the 10% yield on riskless U.S. Treasury bills to calculate the risk-free annual opportunity cost of investment capital.

Each restaurant would involve a capital expenditure of $1.5 million, plus land acquisition costs of $500,000 for Phoenix and $1,050,000 for Tucson. The company uses the 10% yield on riskless U.S. Treasury bills to calculate the risk-free annual opportunity cost of investment capital.

A. Calculate the expected value, standard deviation, and coefficient of variation for each outlet's profit contribution.

B. Calculate the minimum certainty equivalent adjustment factor for each restaurant's cash flows that would justify investment in each outlet.

C. Assuming the management of Tex-Mex is risk averse, and uses the certainty equivalent method in decision making, which is the more attractive outlet? Why?

Definitions:

Pro Forma Income

An estimate of the net income and other financial metrics for a future period, based on projected revenues and expenses.

Nonrecurring

Items or events, such as extraordinary charges or gains, that are not expected to happen regularly or predictably.

Profitability Ratios

Financial metrics used to evaluate a company's ability to generate profit relative to its revenue, assets, equity, or other financial balances.

Enterprise

A business or company organization, including both for-profit and non-profit activities.

Q7: Growth trend analysis assumes:<br>A) constant unit change

Q12: Product Differentiation. Suggest whether each of the

Q19: Market structure is not typically characterized on

Q21: Multiplant Operation. Nature's Green, Inc., a manufacturer

Q26: The Coase Theorem argues that resource allocation

Q38: Demand and Supply Curves. The following relations

Q39: Substitutes and Complements. Determine whether each of

Q40: Pricing Discretion. Would the following factors increase

Q41: A 50% markup on price is equivalent

Q43: Price discrimination exists when:<br>A) costs vary among