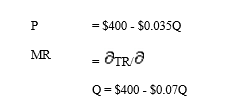

Tariffs. The Nippon Switch Corporation is an importer and distributor of Japanese-made packet switches, special routing devices that direct data traffic to various computers on a large private telecommunications network for companies like GM, Sears and 3M. The U.S. Commerce Department recently informed the company that it will be subject to a new 35% tariff on the import cost of computer switch devices. The company is concerned that the tariff will slow its sales growth, given the highly competitive nature of the packet switch market. Relevant market demand and marginal revenue relations are:

The company's marginal cost equals import costs of $100 per unit, plus $20 to cover transportation, insurance, and related selling expenses. In addition these costs, the company's fixed costs, including a normal rate of return, come to $250,000 per year on this product.

Definitions:

Deeds

Legal documents representing the ownership of property or rights.

Contemplation

The action of looking thoughtfully at something for a long time or the act of thinking deeply about something, especially in a spiritual or introspective manner.

Team Concept

Belief in the principle that together everyone can accomplish more than each could do working alone; tapping the constructive power of the group by having clear and elevating goals, a results-driven structure, competent team members, unified commitment, a collaborative climate, standards of excellence, external support and recognition, and principled leadership.

Objectives

Specific, measurable goals that are set to be achieved within a defined timeframe, serving as benchmarks for success or progress.

Q3: A perfectly functioning cartel results in:<br>A) oligopoly.<br>B)

Q4: What is the small corporation exemption?

Q8: In the short run, a perfectly competitive

Q13: The demand curve for a unique product

Q24: Ed,an individual,incorporates two separate businesses that he

Q28: The first step in most capital budgeting

Q28: Policies that are designed to reduce barriers

Q47: Beige Company has approximately $400,000 in net

Q67: Paul,a cash basis taxpayer,incorporates his sole proprietorship.He

Q75: Arlene,an advertising executive,pays a contractor to build