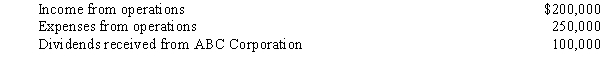

During the year,Quartz Corporation (a calendar year taxpayer)has the following transactions:

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Definitions:

Comparative Advantage

The capability of a person, business, or nation to generate a product or offer a service with a lesser opportunity cost compared to its rivals.

Absolute Advantage

The ability of an individual, company, or country to produce more of a good or service with the same amount of resources as others.

Production Possibilities

Production possibilities involve the various combinations of different goods or services that can be produced in a given economy with available resources and technology, illustrated by the production possibilities frontier.

Production Possibilities Curve

A graphical representation that shows the various combinations of two products that an economy can produce using all its resources efficiently.

Q8: On January 1,Tanager Corporation (a calendar year

Q11: The Celler-Kefauver Act specifically prohibits:<br>A) mergers that

Q22: Compare the sale of a corporation's assets

Q33: Tariffs. The Manchester Shoe Corporation is an

Q36: A present value analysis is required to

Q38: A shareholder transfers a capital asset to

Q41: The capture theory states that:<br>A) certain industries

Q84: Nick exchanges property (basis of $100,000; fair

Q98: Gains and losses are recognized to a

Q134: North Corporation acquires 90% of South's assets