Essay

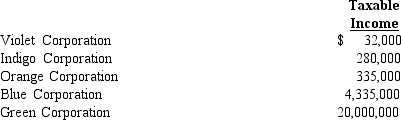

In each of the following independent situations,determine the corporation's income tax liability.Assume that all corporations use a calendar year and that the year involved is 2008.

Definitions:

Related Questions

Q9: A redemption of § 306 stock generates

Q12: Jill has a capital loss carryover in

Q21: Price and product quality competition tends to

Q23: A technical advice memorandum is issued by:<br>A)Treasury

Q32: Eileen transfers property worth $200,000,basis of $60,000,to

Q55: Puffin Corporation has E & P of

Q73: The acquiring corporation in a "Type G"

Q85: Skylark Corporation owns 100% of the outstanding

Q91: On December 29,2008,the directors of Greyhawk Enterprises

Q91: In applying the stock attribution rules to