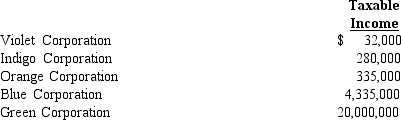

In each of the following independent situations,determine the corporation's income tax liability.Assume that all corporations use a calendar year and that the year involved is 2008.

Definitions:

Depreciate

The process of allocating the cost of a tangible asset over its useful life, reflecting the decline in value over time.

Useful Life

Useful life is the estimated duration of time that an asset is expected to be functional and economically viable for its intended purpose.

Lease Term

The fixed, non-cancellable period during which a lessee has the right to use an asset, with the option for renewal under specific conditions.

Operating Lease

A contract allowing for the use of an asset without ownership, generally resulting in periodic lease payments and not recorded on the lessee's balance sheet under certain conditions.

Q10: Joint action is favored in:<br>A) cooperative games.<br>B)

Q12: Price Discrimination. The Fun-Land Amusement Park is

Q17: Under the "check-the-box" Regulations,a single-member LLC that

Q19: Silver Corporation has accumulated E & P

Q20: In a game:<br>A) there can be no

Q21: Charles is a 45% shareholder and the

Q51: Which of the following types of Regulations

Q53: Herman and Henry are equal partners in

Q58: Describe the requirements for and tax consequences

Q71: The DPAD cannot exceed 50% of the