Short Answer

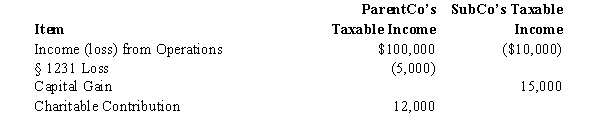

ParentCo and SubCo had the following items of income and deduction for the current year.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Definitions:

Related Questions

Q4: ForCo,a controlled foreign corporation owned 100% by

Q17: Constructive liquidation scenario

Q18: Wren Corporation,a calendar year taxpayer,manufactures and sells

Q23: When Gail dies,she owns 100% of the

Q36: At the beginning of the tax year,Wick's

Q48: Consolidated estimated tax payments are required by

Q77: Consolidated group members are each jointly and

Q83: Mary transfers equipment (basis of $25,000 and

Q107: The losses of a consolidated group member

Q133: Shareholders recognize gains and losses if they