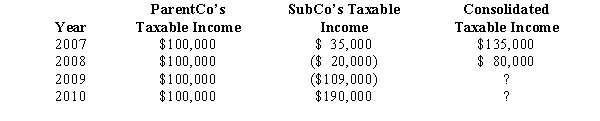

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2007.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

The 2009 consolidated loss:

Definitions:

Adobe Reader

A free application from Adobe Systems that allows users to view, print, and annotate PDF files.

Security Features

Technologies or methodologies implemented to protect information systems and data from unauthorized access or attacks.

HTML Document

A file written in Hypertext Markup Language, forming the structure of web pages and including text, links, and references to images and other media.

View Data

The process or feature that allows users to display and review data within a database or a software application.

Q16: An S corporation may be subject to

Q20: May cause a gain in a "Type

Q24: A limited liability company generally provides limited

Q47: Generally,accrued foreign taxes are:<br>A)Translated at the exchange

Q47: Meal and entertainment expenses not deducted in

Q62: Explain the wages limitation.

Q67: The § 382 NOL limitation rules override

Q87: Alister Corporation would like to enter into

Q106: Reginald and Roland (Reginald's son)each own 50%

Q112: The end results of a "Type C"