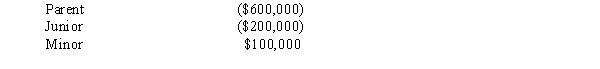

The consolidated group reported the following taxable income amounts.Determine the net operating loss (NOL) that is apportioned to Parent.

Definitions:

Patriot Cause

The movement and ideological drive toward independence from British rule among the American colonies, particularly during the late 18th century.

Thomas Paine

A political activist and writer whose works, including "Common Sense" and "The American Crisis," were influential in the American Revolution and the promotion of democratic ideals.

Benedict Arnold

An American military officer who served during the Revolutionary War before defecting to the British side in 1780, becoming synonymous with betrayal.

American Ally

A country that is in a mutual agreement with the United States to support each other, especially in terms of defense and international policy.

Q1: Heart Corporation has net assets valued at

Q9: The consolidated group reported the following taxable

Q18: Wren Corporation,a calendar year taxpayer,manufactures and sells

Q21: Warbler Corporation distributes all of its property

Q23: All accounts payable of a cash basis

Q29: Wren Corporation (a minority shareholder in Lark

Q40: Which of the following is not generally

Q69: Coral Corporation declares a nontaxable dividend payable

Q90: Noncorporate and corporate shareholders typically do not

Q106: ForCo,a controlled foreign corporation,earns $500,000 in net