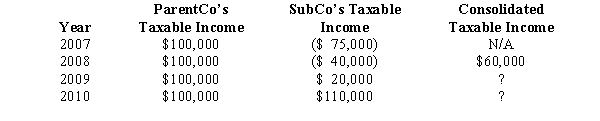

ParentCo purchased all of the stock of SubCo on January 2,2008,and the two companies filed consolidated returns for 2008 and thereafter.Both entities were incorporated in 2007.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.No § 382 limit applies.

To what extent can SubCo's 2007 losses be used by the group in 2010?

Definitions:

Persuaded

Successfully convinced someone to do or believe something through reasoning or argument.

Audience

The group of people targeted or reached by a piece of communication, performance, or work.

Clan Culture

A type of corporate culture that emphasizes family-like relations, teamwork, and loyalty within the organization.

Coordinators

Individuals or roles designated to organize, schedule, and manage activities and resources to ensure efficient operation and achievement of goals.

Q10: In determining whether the meaningful reduction test

Q22: A payment to a retiring partner for

Q27: Type of U.S.-source income potentially taxed to

Q30: Ordering rules

Q40: Section 1248 applies to which of the

Q46: In a corporate liquidation,the built-in loss limitation

Q65: Tern Corporation distributes equipment (basis of $70,000

Q66: All tax preference items flow through the

Q67: Which of the following is not a

Q129: In certain circumstances,an S shareholder's basis in