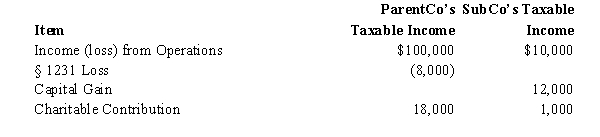

ParentCo and SubCo had the following items of income and deduction for the current year.

Compute ParentCo and SubCo's consolidated taxable income or loss.

Definitions:

Carpel Tunnel Repair

A surgical procedure that aims to relieve symptoms of carpal tunnel syndrome by cutting the ligament pressing on the median nerve in the wrist.

Obstructive Sleep Apnea

A sleep disorder characterized by repeated interruptions in breathing due to a blockage of the airway during sleep.

Pulse Oximetry

A noninvasive method to measure the saturation level of oxygen in the blood, commonly done with a clip-like device on the finger.

Postoperative

Referring to the period or care after a surgical procedure, aimed at recovery and monitoring for complications.

Q4: On June 5,2007,Blue Corporation purchased 10% of

Q20: Inventory with a basis of $10,000 and

Q49: With respect to the AMT,what is the

Q53: A corporate distribution treated as a stock

Q57: Maggie,a partner in the Magpie partnership,received a

Q66: Black Corporation has been engaged in manufacturing

Q69: Richard made a contribution of property to

Q74: A Federal consolidated group makes an annual

Q83: Which of the following is not a

Q90: Direct ownership level before a deemed paid