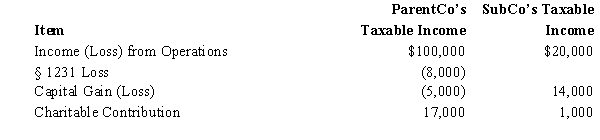

ParentCo and SubCo had the following items of income and deduction for the current year.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Definitions:

Balance Sheet

A report detailing a firm's financial state through a breakdown of its assets, liabilities, and equity from shareholders at a certain moment, offering an overview of its financial health.

Current Liabilities

Short-term financial obligations due within one year or within the company's operating cycle.

Depreciation

Depreciation represents the gradual reduction of the recorded cost of a fixed asset over its useful life, reflecting the asset's wear and tear, deterioration, or obsolescence.

After-Tax Income

The amount of income left after all applicable taxes have been deducted, reflecting the net income available for spending, saving, or investment.

Q2: In a "Type B" reorganization,voting stock of

Q17: When an affiliated group elects to file

Q20: Pink,Corporation,a calendar year taxpayer,made quarterly estimated tax

Q27: All affiliates joining in a newly formed

Q65: Formation of a partnership is generally a

Q67: Emu Corporation (a calendar year taxpayer)has taxable

Q95: Betty's adjusted gross estate is $3 million.The

Q118: A shareholder's basis is decreased by stock

Q133: A Federal consolidated group can claim a

Q156: At the end of 2008,Newt,an S corporation,has