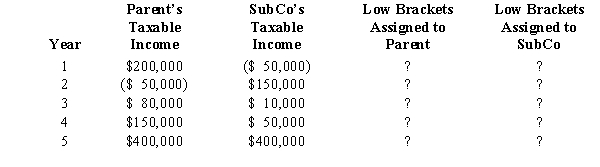

Parent Corporation owns 100% of the stock of SubCo,and the two corporations file a consolidated tax return.Over a five-year period,the corporations generate the following taxable income/(loss).Indicate how you would assign the taxpayers' low marginal rates that apply to the group's first $75,000 of taxable income.Explain the rationale for your recommendation.

Definitions:

Purchasing Department

The division within an organization responsible for acquiring goods, services, and equipment necessary for its operations.

Weighted Average Cost Flow Assumption

An inventory valuation method that calculates the cost of goods sold and ending inventory based on the average cost of all similar items available during the period.

LIFO

Last In, First Out, an inventory valuation method where the most recently produced items are recorded as sold first.

FIFO

An inventory valuation method where the first items produced or purchased are the first used or sold.

Q23: A distribution from a corporation will be

Q29: Built-in gain tax

Q31: Any excess of losses or deductions over

Q32: A § 754 election is made for

Q40: Suzy owns a 25% capital and profits

Q82: The tax treatment of corporate distributions at

Q87: BendCo,Inc.,a U.S.corporation,has foreign-source income and pays foreign

Q94: Bark and Wood Corporations are created by

Q114: Which of the following statements is true

Q135: Deer Corporation was acquired last year by