TopCo owns all of the stock of BottomCo.Both taxpayers are subject to the alternative minimum tax (AMT)this year for the first time,due to a dependence on MACRS deductions.The corporations incurred no intercompany transactions during the year.TopCo has a consolidation election in effect for the group.

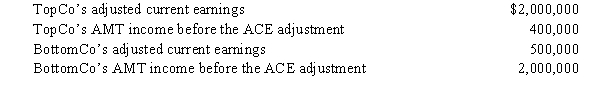

If the affiliates were to file separate Forms 1120 this year,the following amounts would be reported.

a.Compute the ACE adjustment for the consolidated group.

b.Comment on the effects of the consolidation election on the companies' AMT liabilities.

Definitions:

Disfranchised

Individuals or groups deprived of certain rights or privileges, often used in the context of voting rights.

Systematically

Performing actions or procedures in a methodical, organized manner according to a specified system or plan.

Procedural Elements

The structured components or steps that make up a process, governing how something is to be done.

Vague and Open

Descriptions or statements that are intentionally non-specific and broad, allowing for a wide range of interpretation or response.

Q16: During the current year,ALF Partnership reported the

Q33: The maximum individual tax rate is _

Q38: State income taxes paid in 2008.

Q47: Unrealized receivable

Q52: Orange Corporation distributes property worth $200,000,basis of

Q56: A penalty can be assessed by the

Q69: After a plan of complete liquidation has

Q78: Service providing partnership

Q102: The "Type G" reorganization was created by

Q119: Wall Corporation has assets with a $150,000