In the current year,Parent Corporation provided advertising services to its 100%-owned subsidiary,SubCo,under a contract that requires no payments to Parent until next year.Both parties use the accrual method of tax accounting and a calendar tax year.The services that Parent rendered were valued at $100,000.In addition,Parent received $45,000 of interest payments from SubCo.,relative to an arm's length note between them.

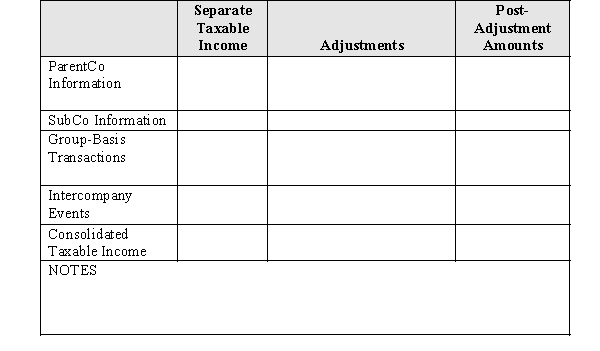

Including these transactions,Parent's taxable income for the year amounted to $300,000.SubCo reported $80,000 separate taxable income.Derive the group's consolidated taxable income,using the format of Figure 8-2.

Definitions:

Virtual Team

A group of individuals who work together from various geographic locations and rely on communication technology to collaborate.

Social Messaging

The use of online platforms and digital communication tools for social interaction and sharing information.

Clear Goals

Specific, well-defined, and understandable objectives that guide actions and decision-making.

Task Performance

Measurement of the efficiency and effectiveness with which job tasks are completed by individuals.

Q2: USCo,a domestic corporation,purchases inventory for resale from

Q4: Members of a controlled group share all

Q16: Earnings already taxed to a U.S.shareholder of

Q18: A U.S.corporation receives a $200,000 dividend from

Q20: ParentCo acquired all of the stock of

Q40: Leonard transfers equipment (basis of $40,000 and

Q84: Nick exchanges property (basis of $100,000; fair

Q90: Kim owns 100% of the stock of

Q116: The "Type E" reorganizations is a _;

Q132: Explain when the IRS would use §