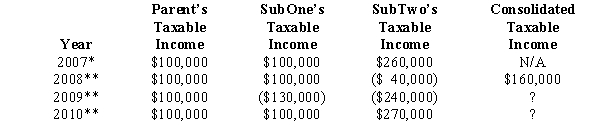

Parent Corporation,SubOne,and SubTwo have filed consolidated returns since 2008.All of the entities were incorporated in 2007.None of the group members incurred any capital gain or loss transactions during 2007-2010,nor did they make any charitable contributions.Taxable income computations for the members are listed below.

* Separate return year.

** Consolidated return year.

a.How much of the 2009 loss is apportioned to SubOne and SubTwo? How is this loss treated in generating a refund of prior tax payments?

b.Why would Parent consider electing to forgo the carryback of the 2009 consolidated NOL?

c.In this light, analyze the election to consolidate.

Definitions:

Germany

A country in Central Europe known for its rich history, cultural heritage, and significant economic power.

Codetermination

A practice where workers have a say in the management of a company through participation in its boards or committees, promoting more democratic workplace governance.

Employee representation

The practice of workers electing delegates or representatives to discuss and negotiate working conditions, pay, and other employment issues with management.

Supervisory boards

Bodies appointed in some organizations to oversee the activities and management decisions, typically distinct from daily operations.

Q14: Kingbird Corporation (E & P $400,000)has 2,000

Q17: When a corporation makes an installment sale,for

Q29: Built-in gain tax

Q58: Describe the requirements for and tax consequences

Q67: Cardinal Corporation (E & P of $700,000)has

Q68: When an S corporation liquidates,which of its

Q79: ParentCo's controlled group includes the following members.ParentCo

Q101: Lott Corporation in Macon,Georgia converts to S

Q106: For a corporate restructuring to qualify as

Q125: Snow Corporation desires to change to an