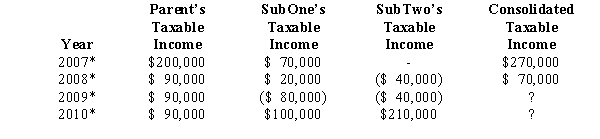

The group of Parent Corporation,SubOne,and SubTwo has filed a consolidated return since 2008.The first two entities were incorporated in 2007,and SubTwo came into existence in 2008 through an asset spin-off from Parent.Taxable income computations for the members are shown below.None of the group members incurred any capital gain or loss transactions during 2007-2010,nor did they make any charitable contributions.

Describe the treatment of the group's 2009 consolidated NOL.Hint: Apply the offspring rule.

* Consolidated return year.

Definitions:

Cubans

Refers to the people hailing from Cuba, a country in the Caribbean, or their descendants living abroad.

Saddam Hussein

The fifth President of Iraq, serving from 1979 until 2003, known for his authoritarian rule and involvement in conflicts such as the Iran-Iraq War and the Gulf War.

Seize Iran's Oil

Refers to efforts or strategies, particularly by foreign powers, to control or influence Iran's oil reserves, which are among the world's largest, for strategic, economic, or political reasons.

Congressional Democrats

Members of the Democratic Party serving in the United States Congress, advocating for progressive policies and legislation.

Q12: Limited liability company

Q17: In order to encourage the redevelopment of

Q31: The end result of a "Type A"

Q40: Intangible drilling costs deducted currently.

Q47: Generally,accrued foreign taxes are:<br>A)Translated at the exchange

Q64: Roxanne contributes land to the RB Partnership

Q94: S corporations are treated as partnerships under

Q102: As of January 1 of the current

Q116: An S shareholder who dies during the

Q136: A disadvantage of corporations (both C corporations