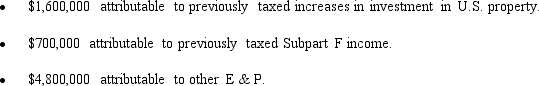

Benchmark,Inc.,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.

Benchmark recognizes a taxable dividend of:

Definitions:

Successful Entrepreneurs

Individuals who have achieved significant success in creating and managing ventures that bring innovative products or services to market.

Smartest Person

An individual renowned for having a high level of intelligence and the capability to solve complex problems efficiently and effectively.

Education

The process of receiving or giving systematic instruction, especially at a school or university.

Freedom To Experiment

Allowing individuals or teams to try new methods, approaches, or ideas without fear of immediate repercussions, encouraging innovation and learning from failure.

Q2: Techniques that can be used to minimize

Q15: KeenCo,a domestic corporation,is the sole shareholder of

Q29: Flamingo Corporation (E & P of $700,000)has

Q31: Most of the rules governing the use

Q57: A shareholder's basis in property received in

Q78: During 2008,Martina,an NRA,receives interest income of $50,000

Q87: BendCo,Inc.,a U.S.corporation,has foreign-source income and pays foreign

Q106: Reginald and Roland (Reginald's son)each own 50%

Q122: Gains on the sale of U.S.real property

Q126: Brighton Corporation requires all of its shareholders