Essay

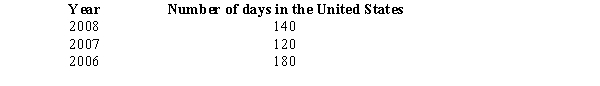

Given the following information,determine whether Greta,an alien,is a U.S.resident for 2008.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Definitions:

Related Questions

Q14: Kingbird Corporation (E & P $400,000)has 2,000

Q16: One reason for granting an exemption from

Q19: The MOG Partnership reports ordinary income of

Q32: BlueCo,a domestic corporation,incorporates its foreign branch in

Q57: All losses are apportioned against U.S.-source income.

Q58: Samantha's basis for her partnership interest is

Q59: Member's operating gains/profits

Q81: Cindy,a 20% general partner in the CDE

Q85: The § 465 at-risk provision and the

Q96: A Qualified Business Unit of a U.S.corporation