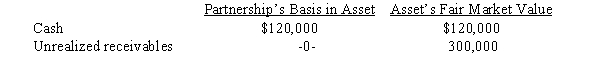

Greg has a 20% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on September 1 of the current year is $300,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Greg.

a.Calculate Greg's recognized gain or loss on the liquidating distribution, if any.

a. change if the partnership also distributed a chair to Greg? Assume the chair has a $500 adjusted basis (FMV is $800) to the partnership.

b.How would your answer to

Definitions:

Letters Patent Corporation

A document issued by a government granting rights, privileges, or status to an individual or company, historically used to establish corporations.

Limited Liability Partnership

A partnership where some or all partners have limited liabilities, meaning they are not personally responsible for the debts of the business.

Capital Contributions

Funds or assets contributed to a partnership or corporation by its owners or partners to support its operations or finance its objectives.

Negligence

The failure to exercise the care that a reasonably prudent person would exercise in like circumstances, resulting in harm or damage to another.

Q9: An S corporation reports $10,000 DPGR and

Q11: Sale of the corporate assets by the

Q26: Which of the following transactions,if entered into

Q43: In its first year of operations (2008),Auburn,Inc.(a

Q47: In an affiliated group,the parent must own

Q69: The general rule for corporate reorganizations is

Q75: Which of the following are consequences of

Q129: In certain circumstances,an S shareholder's basis in

Q145: The taxable LIFO recapture amount equals the

Q149: Which of the following qualify as exempt