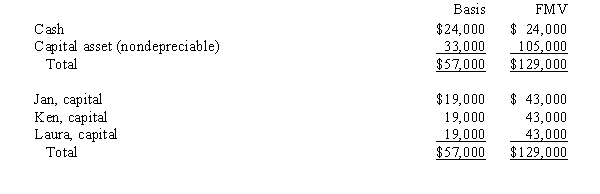

The December 31,2008,balance sheet of the calendar-year JKL Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction and credit.On December 31,2008,Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash.Assume the partnership makes a § 754 election for 2008.

a.What is the amount of Jennifer's "step-up" adjustment under § 743(b)?

b.If the nondepreciable capital asset is sold the next year for $120,000, determine the amount of gain that Jennifer will recognize on her tax return because of the sale.

Definitions:

Concentrated Practice

A focused method of improving skills by repeatedly performing tasks or activities with intentional efforts to correct errors and refine performance.

Productivity

The measure of efficiency in which goods or services are produced, often evaluated in terms of output per unit of input.

Transformational Grammar

A theory of grammar that considers the syntactic structures of language as being generated by a set of rules.

Deep Structure

In linguistics, the underlying syntactic structure or meaning of a sentence, as opposed to the surface structure which is how the sentence is expressed verbally.

Q21: Land held by the partnership for investment

Q33: Economic effect test

Q49: Since a "Type F" reorganization causes only

Q55: An activity is not an unrelated trade

Q65: In the year a subsidiary begins to

Q67: Which of the following is not a

Q75: Any losses that are suspended under the

Q95: S corporation losses are allocated on a

Q118: Charitable contribution

Q135: Tax deferred reorganizations involving U.S.-owned foreign corporations