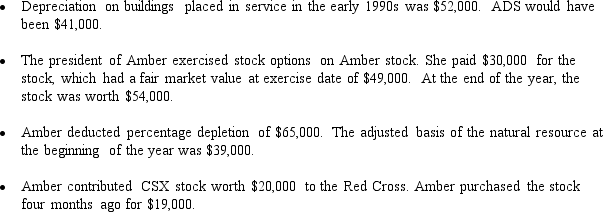

Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

Definitions:

Total Compensation

The complete reward package provided to an employee, including base salary, bonuses, benefits, and any other financial remunerations.

Confidence Interval

A range of values within which there is a specified probability that the true parameter value lies.

Confidence Interval

A range of values, derived from sample statistics, that is likely to contain the true population parameter.

Population Mean

The average value of all measurements in a population, reflecting the central location of the data.

Q10: The key factor in determining whether an

Q11: Sale of the corporate assets by the

Q43: An S corporation's AAA cannot have a

Q53: Rose,an S corporation,distributes land to Walter,its only

Q54: Payment to a general partner for $10,000

Q55: A corporation may alternate between S corporation

Q98: Last year,Ned's property tax deduction on his

Q132: Which,if any,of the following items has no

Q138: The benefits of a passive investment company

Q159: Why is a knowledge of Federal income