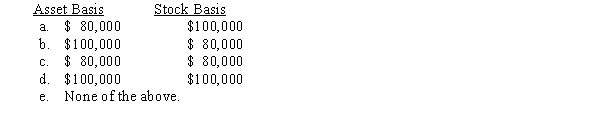

Trolette contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a C corporation and the transaction qualifies under § 351,the corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Tendered

Offered formally or presented for acceptance.

Insolvent

Inability of a business entity to pay its debts as they become due in the usual course of business.

Premium Bicycles

High-quality bicycles often featuring advanced materials, technology, and design, and typically sold at a higher price point than standard models.

Freight Truck

A large vehicle used for transporting bulk goods, materials, or commodities over land.

Q6: Monroe,a 1/3 partner with a basis in

Q14: Sarah owns a 30% interest in the

Q35: The U.S.system for taxing income earned outside

Q36: Parrot,Inc.,a C corporation,distributes $50,000 to its shareholder,Jerome,and

Q54: Payment to a general partner for $10,000

Q61: Foreign taxpayers earning income inside the United

Q66: Kevin,Chuck,and Greg contributed assets to form the

Q82: While the S corporation generally is a

Q145: The Statements on Standards for Tax Services

Q148: A service engineer spends 30% of her