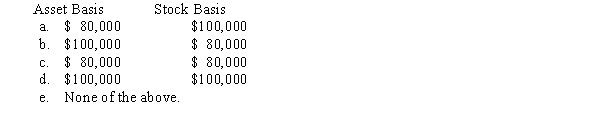

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a partnership and the transaction qualifies under § 721,the partnership's basis for the property and the partner's basis for the partnership interest are:

Definitions:

Innocent Misrepresentation

A type of misrepresentation in legal contexts where the person making the misrepresentation genuinely believes it to be true, lacking intent to deceive.

Unilateral Mistake

A legal term describing a situation where only one party to a contract is mistaken about a basic assumption on which the contract is based.

Innocent Misrepresentation

A false statement made without knowledge of its falsity, not intended to deceive, which can lead to a contract being voided if relied upon by the other party.

Rescission

The legal remedy of canceling, terminating, or annulling a contract and restoring the parties to their original positions as if the contract had never been made.

Q12: Making distributions to shareholders that are deductible

Q13: Which type of distribution from an S

Q24: In determining a corporation's taxable income for

Q43: Typically exempt from the sales/use tax base

Q45: Conducting an advertising campaign on local TV

Q55: Last year,Oscar contributed nondepreciable property with a

Q63: The ABC Partnership makes a proportionate distribution

Q73: The IRS responds to a taxpayer request

Q96: The excise tax imposed on private foundations

Q103: Private foundations are not permitted to engage