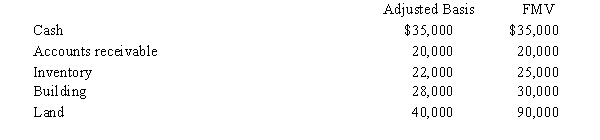

Lee owns all the stock of Vireo,Inc.,a C corporation for which he has an adjusted basis of $150,000.The assets of Vireo,Inc.,are as follows:

Lee sells his stock to Katrina for $200,000.

a.Determine the tax consequences to Lee.

b.Determine the tax consequences to Katrina.

c.Determine the tax consequences to Vireo, Inc.

Definitions:

Social Roots

The foundational social influences and contexts from which individuals' behaviors, beliefs, and identities originate.

Cognitive Roots

Fundamental aspects or underlying elements of cognitive processes, such as perception, memory, and reasoning.

Emotional Roots

The underlying emotional causes or bases for behaviors, thoughts, or feelings, often linked to past experiences.

Just-World Phenomenon

The cognitive bias to believe that the world is fundamentally fair, leading people to rationalize an unjust situation as deserved by the victim.

Q8: Spare parts for manufacturing machinery

Q28: On the first day of the current

Q30: Groceries purchased and taken home

Q48: Payment of $100,000 cash,representing the partner's share

Q51: Which of the following statements regarding intermediate

Q52: Which of the following items are increases

Q59: Marty receives a proportionate nonliquidating distribution when

Q79: Maria's AGI last year was $195,000.To avoid

Q96: A state cannot levy a tax on

Q108: Shareholders owning a(n)_ of shares (voting and