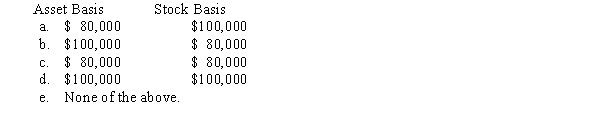

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a partnership and the transaction qualifies under § 721,the partnership's basis for the property and the partner's basis for the partnership interest are:

Definitions:

Speech Area

Regions in the brain, primarily located in the left hemisphere, involved in the processing and production of language.

Electrical Stimulation

A therapeutic treatment that uses electrical current to cause a single muscle or a group of muscles to contract, thereby improving muscle strength, pain relief, and repairing tissue.

Echolocation

The process of using sound waves and echoes to determine where objects are in space. It is used by animals like bats and dolphins to navigate and hunt.

Brain Regions

Specific areas within the brain, each with distinct functions and structures, contributing to the complex processes of thought, emotion, and sensory processing.

Q6: A capital stock tax usually is structured

Q10: The MNO Partnership,a calendar year taxpayer,was formed

Q12: If a foreign corporation's U.S.effectively connected earnings

Q25: Which of the following statements is correct?<br>A)A

Q34: José Corporation realized $600,000 taxable income from

Q55: Last year,Oscar contributed nondepreciable property with a

Q71: In most states,a taxpayer's income is apportioned

Q71: Meagan is a 40% general partner in

Q97: With respect to passive losses,there are three

Q110: The IRS uses document matching programs to