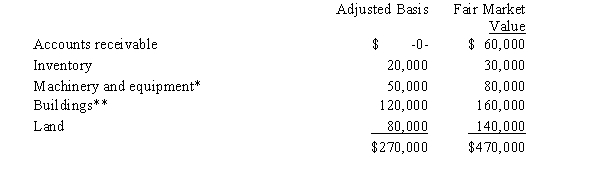

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $30,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $470,000.

Definitions:

Technological Advance

(1) An improvement in the quality of existing products, the invention of entirely new products, or the creation of new or better ways of producing or distributing products. (2) Any improvement in the methods by which resources are combined such that the same quantity of inputs can be made to yield a combination of outputs that is preferred to any combination of outputs that was previously possible.

Freedom of Choice

The right of individuals to make decisions for themselves without undue government restriction.

Society's Wants

The collective desires and needs of a community or society that drive demand and economic activity.

Q1: An exempt organization will not have any

Q9: A controlled foreign corporation (CFC)realizes Subpart F

Q20: Pearl,Inc.,a tax-exempt organization,leases a building and machinery

Q32: If a taxpayer contributes an appreciated asset

Q48: According to the IRS,the annual "Tax Gap"

Q75: Which of the following business entity forms

Q84: Misstatement of withholding allowances

Q124: Pepper,Inc.,an S corporation in Norfolk,Virginia,has revenues of

Q134: State A applies a throwback rule,but State

Q158: Tan,Inc.,a tax-exempt organization,has $65,000 of net unrelated