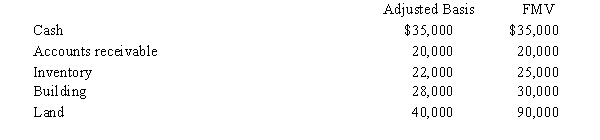

Lee owns all the stock of Vireo,Inc.,a C corporation for which he has an adjusted basis of $150,000.The assets of Vireo,Inc.,are as follows:

Lee sells his stock to Katrina for $200,000.

a.Determine the tax consequences to Lee.

b.Determine the tax consequences to Katrina.

c.Determine the tax consequences to Vireo, Inc.

Definitions:

Local Cultures

The distinct ways of life, traditions, customs, and social practices found within specific geographic areas, communities, or social groups.

Radio

A form of media that transmits audio content to the public through electromagnetic waves, allowing for live entertainment, news, and information to be shared.

Tax Benefits

Tax benefits refer to deductions, exclusions, or credits that reduce the amount of taxes owed to the government.

Music Industry

The music industry consists of businesses and individuals who create, produce, market, and distribute musical performances and recordings.

Q1: The throwback rule requires that:<br>A)Sales of services

Q32: An S corporation in Lawrence,Kansas has a

Q34: During an audit,either the IRS or the

Q43: In its first year of operations (2008),Auburn,Inc.(a

Q60: A letter ruling can be used to

Q84: Eagle,Inc.recognizes that it may have an accumulated

Q108: A general requirement for exempt status is

Q113: An S corporation cannot incur a tax

Q118: Bilateral agreement between two countries related to

Q139: Failure to pay a tax