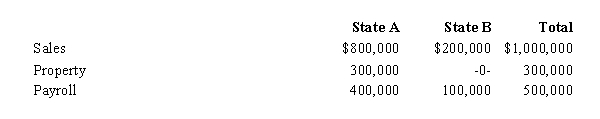

Condor Corporation generated $450,000 of state taxable income from selling its product in States A and B.For the taxable year,the corporation's activities within the two states were as follows.

Condor has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula that equally weights sales,property,and payroll.The rates of corporate income tax imposed in A and B are 10% and 6%,respectively.Determine Condor's state income tax liability.

Definitions:

Legal Liability

The responsibility imposed by law to compensate for or rectify any harm, loss, or damage one's actions or decisions have caused to others.

Sales Taxes

These are taxes imposed by governments on the sale of goods and services.

Sick Pay

Compensation paid by employers to employees during periods when they are unable to work due to illness.

Cumulative Preferred Stock

Cumulative preferred stock is a type of preferred stock that accumulates dividends in case of non-payment in any period, requiring these dividends to be paid out before any dividends to common stockholders.

Q5: The deemed paid credit allowed for past

Q42: Which exempt organizations are not required to

Q44: In a few states,a Federal S corporation

Q69: A taxpayer has an AMT base of

Q77: C corporations and S corporations can generate

Q88: § 501(c)(3)organization

Q98: Tenancy by the entirety

Q112: Even though substantially all the work of

Q145: Leonard inherits a traditional IRA from his

Q173: Van takes out an insurance policy on