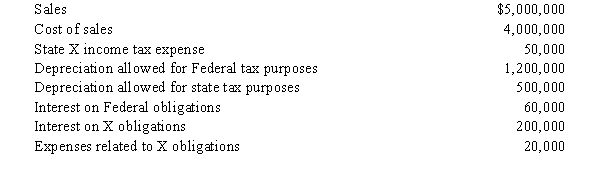

Node Corporation is subject to tax only in State X.Node generated the following income and deductions.State income taxes are not deductible for X income tax purposes.

a.The starting point in computing the X income tax base is Federal taxable income. Derive this amount.

b.Determine Node's X taxable income, assuming that interest on X obligations is exempt from X income tax.

c.Determine Node's taxable income, assuming that interest on X obligations is subject to X income tax.

Definitions:

Menswear

Clothing and apparel specifically designed for men, encompassing a range of items such as suits, trousers, shirts, and footwear.

Photography Equipment

Tools, machines, and accessories used for taking photographs, such as cameras, lenses, lighting, and tripods.

Invoice

A document issued by a seller to a buyer that lists goods or services provided, the costs, and the payment terms.

Dairy Products

Foods produced from the milk of mammals, such as cheese, milk, butter, and yogurt.

Q5: Bert Corporation,a calendar-year taxpayer,owns property in States

Q20: A typical state taxable income addition modification

Q29: Babs filed an amended return in 2008,claiming

Q38: Form 2758

Q39: Mandy Corporation realized $1,000,000 taxable income from

Q45: Derek and Tanya are husband and wife

Q84: The election of the alternate valuation date

Q89: In most states,a limited liability company (LLC)is

Q90: In full settlement of her marital rights,Henry

Q110: Under the Tax Relief Reconciliation Act of