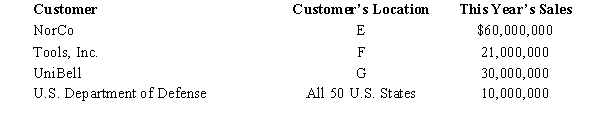

State E applies a throwback rule to sales,while State F does not.State G has not adopted an income tax to date.Mercy Corporation,headquartered in F,reported the following sales for the year.All of the goods were shipped from Mercy's F manufacturing facilities.Mercy's degree of operations is sufficient to establish nexus only in E and F.Determine its sales factor in those states.

Definitions:

Self-actualizers

Individuals who have realized their potentials and capacities, fulfilling their inherent possibilities.

Conflict And Tension

A state of disagreement or discord that arises when two or more parties have incompatible objectives, values, or needs.

Self-actualizers

Individuals who have fulfilled their potential and achieved the highest level of Maslow's hierarchy of needs, focusing on personal growth and self-fulfillment.

Independent

Describes the ability to act and make decisions without being influenced by others, often highlighting self-sufficiency.

Q25: Mr.and Ms.Smith's partnership owns the following assets:<br>*

Q39: Mandy Corporation realized $1,000,000 taxable income from

Q49: Surviving owners agree to purchase withdrawing owner's

Q61: Any recapture of special use valuation estate

Q68: States collect the most tax dollars from

Q97: Which,if any,of the following is a correct

Q113: A garment purchased by an actress

Q115: Failure to file and failure to pay

Q140: § 501(c)(5)labor organization

Q158: Tan,Inc.,a tax-exempt organization,has $65,000 of net unrelated