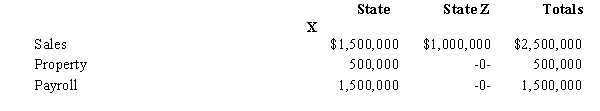

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales,payroll,and property among the states include the following.

Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

Definitions:

Perceptual-Motor Coupling

refers to the coordination between perception and movement, allowing individuals to execute tasks based on sensory inputs.

Gross Motor Coordination

The ability of the body to perform large, physical movements that require the coordination of muscles and limbs.

Ecological View

An approach or perspective that emphasizes the relationships between organisms and their environment.

Constructivist View

An educational theory that emphasizes the learner's active role in constructing knowledge based on their experiences and interactions.

Q24: Eric dies at age 96 and is

Q47: Which of the following statements related to

Q51: Fraudulent failure to file

Q82: Which,if any,of the following can be eligible

Q95: Homer purchases a U.S.savings bond listing title

Q133: Since loss property receives a _ -

Q149: The property factor includes assets that the

Q152: The LIFO recapture tax is a variation

Q153: Debt-financed property consists of all real property

Q156: At the end of 2008,Newt,an S corporation,has