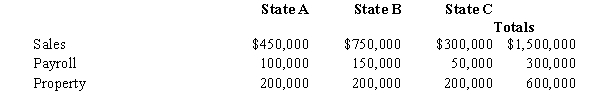

-Tripp Corporation owns manufacturing facilities in States A,B,and C.A uses a three-factor apportionment formula under which the sales,property and payroll factors are equally weighted.B uses a three-factor apportionment formula under which sales are double-weighted.C employs a single-factor apportionment factor,based solely on sales.

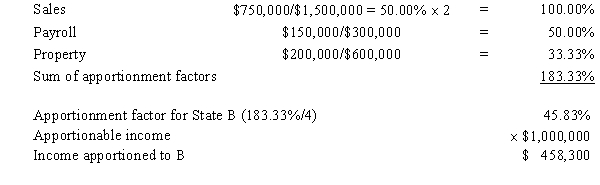

Tripp's operations generated $1,000,000 of apportionable income,and its sales and payroll activity and average property owned in each of the three states is as follows.

Tripp's apportionable income assigned to C is:

Definitions:

Total Costs

The sum of all expenses (fixed and variable) incurred in the production of goods or services.

Long-Run Total Cost

The total cost incurred by a firm when all inputs, including both fixed and variable costs, are fully adjustable.

Long-Run Supply Function

A relationship that shows the quantity of goods a firm is willing and able to produce and supply to the market at different possible prices over a long period, considering all inputs as variable.

Factor Prices

The amounts paid to the factors of production, such as wages for labor, rent for land, and profit for capital.

Q1: An exempt organization will not have any

Q47: Most states waive the collection of sales

Q74: An effective way for all C corporations

Q78: _ describe(s)the degree of business activity that

Q86: Compensation for services rendered to an S

Q91: Tax on self-dealing

Q116: The Federal gift and estate taxes were

Q151: A lifetime transfer that is supported by

Q161: For year 2008,the unified transfer tax credit

Q193: In the case of a transfer by