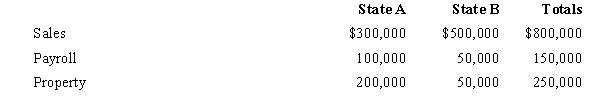

Boot Corporation is subject to income tax in States A and B.Boot's operations generated $1,200,000 of apportionable income,and its sales and payroll activity and average property owned in each of the states is as follows.

How much more (less) of Boot's income is subject to A income tax if,instead of using an equally-weighted three-factor apportionment formula,A uses a formula with a double-weighted sales factor?

Definitions:

Welfare Loss

The decrease in social welfare, usually measured in terms of lost economic efficiency or satisfaction, due to factors like taxes or monopolies.

Import Quota

A restriction imposed by a government on the quantity of a specific good that can be imported into a country during a specified time period.

Domestic Production

Domestic production denotes the total output of goods and services produced within a country's borders, reflecting the overall productive capacity and economic health of the nation.

GATT

The General Agreement on Tariffs and Trade, an international treaty designed to reduce trade barriers and promote international commerce.

Q9: The IRS is a subsidiary agency of

Q18: Low cost articles

Q41: Under P.L.86-272,which of the following transactions by

Q71: The benefits of the AAA can be

Q75: Manfredo makes a donation of $50,000 to

Q79: Maria's AGI last year was $195,000.To avoid

Q81: University of Virginia

Q121: Maureen,a calendar year taxpayer subject to a

Q127: Bev and Cabel each own one-half of

Q140: Credit for state death taxes (under §