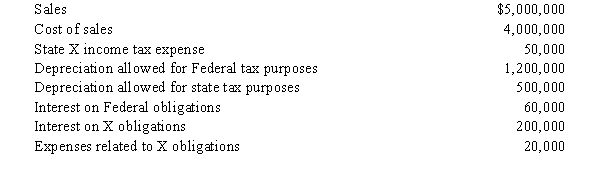

Node Corporation is subject to tax only in State X.Node generated the following income and deductions.State income taxes are not deductible for X income tax purposes.

a.The starting point in computing the X income tax base is Federal taxable income. Derive this amount.

b.Determine Node's X taxable income, assuming that interest on X obligations is exempt from X income tax.

c.Determine Node's taxable income, assuming that interest on X obligations is subject to X income tax.

Definitions:

Performance

The act of fulfilling the duties or obligations specified in a contract or agreement.

Oral Modifications

Changes to a contract or agreement made through spoken communication between the parties involved, rather than in written form.

Parol Evidence Rule

A rule in contracts law that prevents parties from presenting extrinsic evidence of terms of the contract that contradict, modify, or vary contractual terms written in the contract document.

Oral Evidence

Testimony or statements spoken out loud in court as opposed to written evidence.

Q26: Maroon,Inc.,a tax-exempt organization,leases a building and machinery

Q28: Discount attributable to a large number of

Q52: Donee's basis for gain.

Q73: The IRS responds to a taxpayer request

Q95: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q118: S corporation.

Q132: Deferral approach.

Q157: Which,if any,of the following statements properly characterize

Q163: Walt dies intestate (i.e.,without a will)in 2006

Q197: The deemed paid adjustment compels a taxpayer