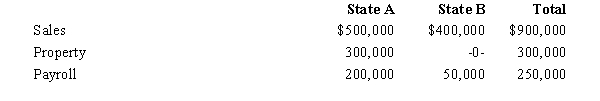

-Dott Corporation generated $300,000 of state taxable income from selling its mapping software in States A and B.For the taxable year,the corporation's activities within the two states were as follows.

Dott has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula equally weights sales,property,and payroll.The rates of corporate income tax imposed in A and B are 10% and 6%,respectively.Determine Dott's state income tax liability.

Definitions:

Critical Listening

Listening to evaluate and assess the quality, appropriateness, value, or importance of information.

Listener Apprehension

The anxiety or fear felt by individuals when they need to listen to others, often due to concerns about comprehending or retaining the information.

Nonverbal Cues

Signals or gestures used in communication that do not involve the use of words, including facial expressions, body language, and tone of voice.

Eye Contact

The act of looking directly into another person’s eyes, which can communicate various messages and emotions, depending on the cultural context.

Q6: Paula creates a trust,income payable to John

Q11: When a practitioner discovers an error in

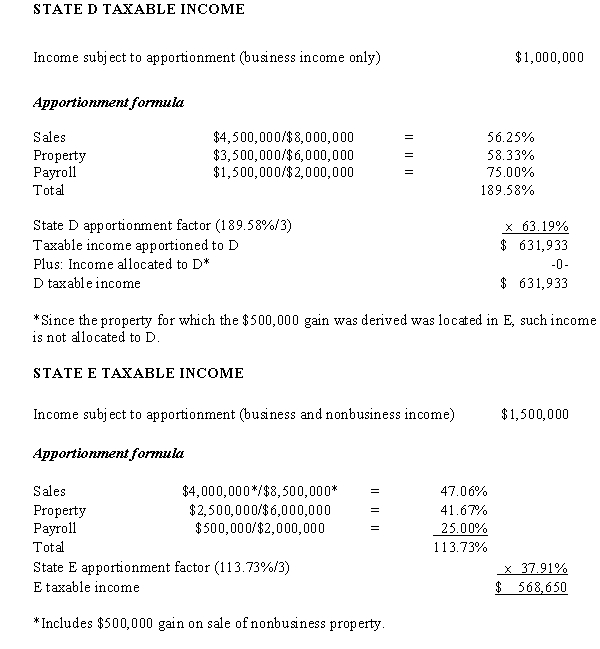

Q66: Condor Corporation generated $450,000 of state taxable

Q74: A disclaimer by a surviving spouse may

Q78: _ describe(s)the degree of business activity that

Q97: Which,if any,of the following is a correct

Q99: Eliminates common stock from donor's gross estate.

Q116: The Federal gift and estate taxes were

Q133: To be classified as a private foundation,the

Q137: Organization costs.