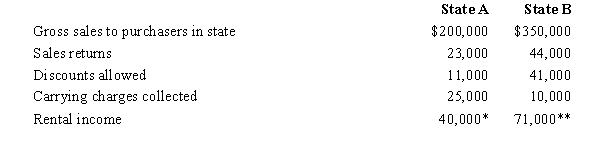

Shaker Corporation operates in two states,as indicated below.All goods are manufactured in State A.Determine the sales to be assigned to both states to be used in computing Shaker's sales factor for the year.Both states follow the UDITPA and the MTC regulations in this regard.

* Excess warehouse space

** Land held for speculation

Definitions:

Implied Warranty

A legal term indicating that a product is guaranteed to function as it is supposed to, even if not explicitly stated.

Warranty Of Fitness

A guarantee that a product will meet a buyer's specified needs and expectations.

Express Warranty

A written guarantee, issued to the purchaser of an item, promising to repair or replace it if necessary within a specified period.

Trade Usage

Customary practices and norms adopted by a particular industry or commerce sector that can influence the interpretation and enforcement of contracts.

Q9: The election of the alternate valuation date

Q22: Judy,a regional sales manager,has her office in

Q46: Purchase out-of-state realty.

Q61: In 1997,Katelyn inherited considerable property when her

Q61: Any recapture of special use valuation estate

Q121: Some states impose inheritance taxes,but the Federal

Q124: A few states recognize an entity's S

Q126: In a typical "estate freeze" involving stock:<br>A)The

Q145: The taxable LIFO recapture amount equals the

Q198: In 1980,Marie and Hal (mother and son)purchased