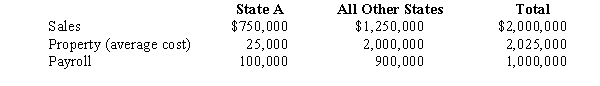

You are completing the State A income tax return for Quaint Corporation.Quaint is a limited liability company,and it operates in various states,showing the following results.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Assuming the following data are correct,compute Quaint's A taxable income.

Definitions:

Mirror Neurons

Neurons that fire both when an individual acts and when the individual observes the same action performed by another, thought to be the basis of empathy and understanding others' actions.

Hopscotch

A children's game involving throwing a small object into numbered spaces outlined on the ground and hopping through the spaces to retrieve the object.

Systematic Desensitization

A behavioral therapy technique used to reduce phobia or anxiety through gradual exposure to the feared object or situation coupled with relaxation exercises.

Counterconditioning

A behavior therapy technique where an undesirable response to a stimulus is replaced with a more desirable response.

Q21: Most states begin the computation of taxable

Q22: The accumulated earnings tax rate in 2008

Q24: Failure to file a return

Q36: At the time of his death,Rex owned

Q50: What characteristics must be present for an

Q61: In 1997,Katelyn inherited considerable property when her

Q87: Overall tax liabilities will _ if the

Q126: Faye,a CPA,is preparing Judith's tax return.One item

Q155: Why are some organizations exempt from Federal

Q156: Nice,Inc.,a § 501(c)(3)organization,inherited 100% of the stock