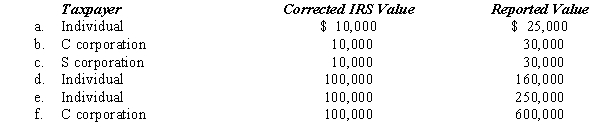

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 30%.

Definitions:

Expectations

The beliefs or forecasts people have about the future or about the outcomes of specific actions.

Observable Culture

The components of culture that can be seen in an organization.

Personal Appearances

The way an individual presents themselves physically in various contexts, which can influence perceptions and interactions.

Dress Codes

Established guidelines prescribing the expected attire for individuals in specific environments or during particular events.

Q6: What planning opportunity may be available for

Q31: Define a qualified corporate sponsorship payment.

Q31: In planning for the use of §

Q63: Doubles the number of annual exclusions available.

Q64: Private foundation

Q113: Max (a calendar year taxpayer)donates a painting

Q116: § 501(h)

Q127: The Jain Estate is required to pay

Q151: A lifetime transfer that is supported by

Q164: List some of the most commonly encountered